I write a best-selling newsletter called Sex and the State. That’s my full-time job. It covers gender and politics, among other topics.

There’s a section of a post I wrote recently that I wanted to share with my Advance Huntsville homies.

I want to highlight my response to Jared Yates Sexton where he writes that “corporations have decimated home ownership.” This matters to me because I see far too many people blaming corporations for the housing crisis. And honeys, I wish it were true. You cannot imagine how much I would love it if nameless, faceless, unpopular corporate boogeymen were the main reason, or even a major contributor to, skyrocketing housing costs.

But they’re just not. And that matters to me because we literally can’t fix housing if we don’t understand who and what broke it.

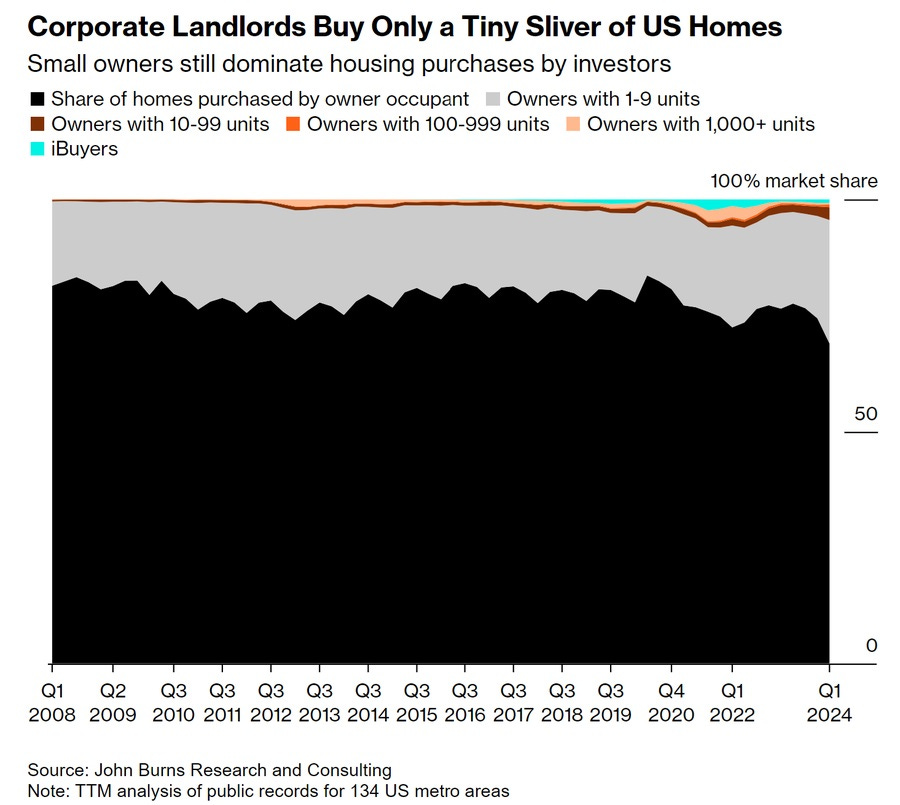

The first problem with the “corporations are why we can’t afford housing” thesis is that corporations don’t own anywhere near enough homes to impact overall affordability:

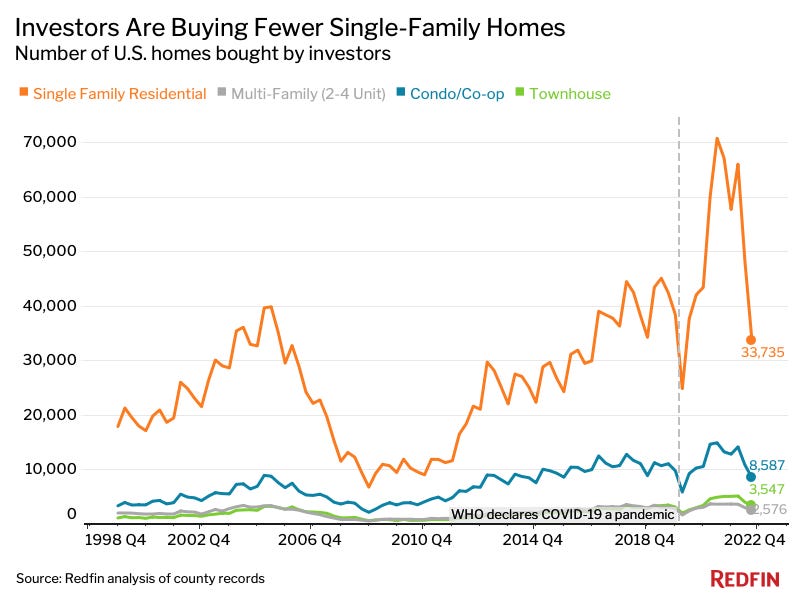

In reality, housing costs are up for the same reason the corporations are buying any single-family homes. We’re not building enough new homes where people want to live. Low supply and high demand raises housing prices. So fewer families are buying and corporations have an incentive to invest in an appreciating asset.

I’m not particularly invested in making life easier for corporations or landlords. I’m certainly not trying to help corporate landlords. But I do want to solve the housing crisis. And there’s no kind or amount of restricting or regulating corporate landlords that will make any difference whatsoever. The one move that will solve the problem also happens to deprive landlords (of all varieties) of exploitative rents. And that’s building a lot more housing of various kinds and price levels where people want to live. (Let’s legalize ADUs!)

So that’s the main point I wanted to share with y’all.

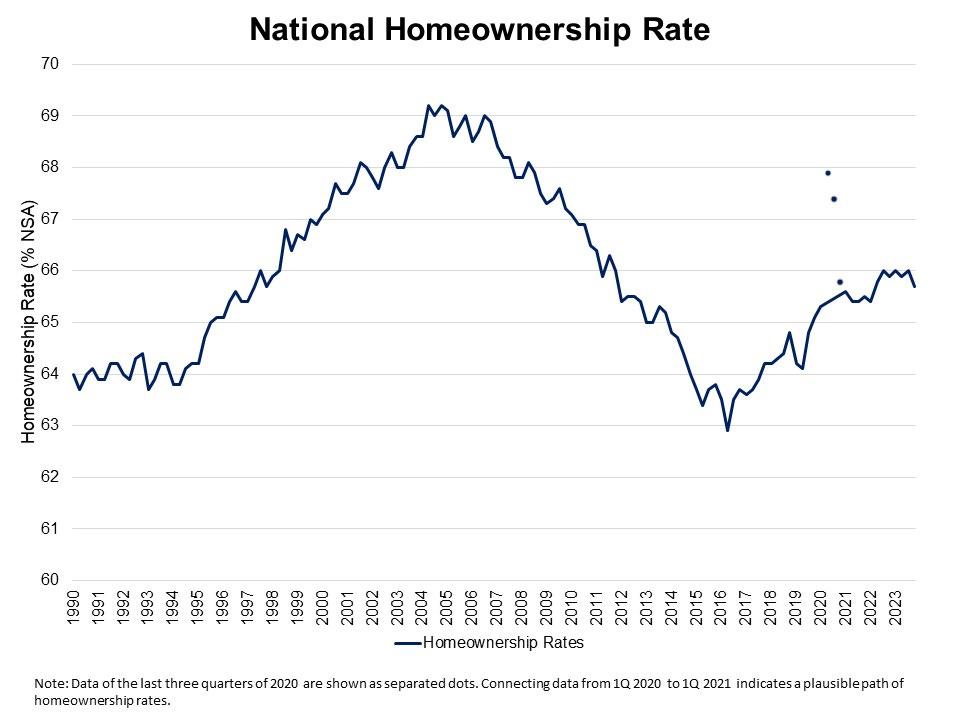

But, if you’re interested, there are other reasons Sexton is wrong about homeownership and corporate landlords. First, homeownership isn’t decimated.

Second, the homeownership rate and the rate at which corporations purchase single-family homes are actually inversely correlated. Which would mean one can’t cause the other.

We know what the jurisdictions with more abundant housing look like. They do not have robust social housing programs. They do not have wildly different antitrust policies. They have not banned foreign investors from buying homes, or banned the practice of buying single-family homes to rent them out.

What they have is a more elastic housing supply. If you feel that your state is doing below average housing-wise, the solution is to change laws to make it easier to build houses. If you don’t actually want to solve this problem and would rather talk about something else, that’s fine! But if you’re genuinely concerned about housing, you have to address the core issue.

Anyway, send this post to the next person who tries to pin the housing crisis on corporate landlords. And if you want to read my newsletter (and help me afford to keep my cats in wet food) head on over to Sex and the State.